Your Amortization Details (Yearly/Monthly)

What is an EMI Calculator?

An EMI Calculator allows an individual to calculate the EMI (Equated Monthly Instalments) through loan-specific inputs like interest rate, tenure, loan amount, etc.

Using an EMI calculator helps you find the best combination of the interest rate, loan amount, and loan tenure for smooth EMI repayment planning.

Why is an EMI Calculator Helpful?

An EMI Calculator assists in anticipating all the essentials of your loan repayment, allowing you to plan your loan better. With a planned approach, you can gain a clearer picture of all your monthly expenses, including the EMI.

What Fields Does an EMI Calculator Have?

Loan Amount

The loan amount is a crucial factor influencing your EMI. Your loan amount should be chosen after a thorough analysis of your financial needs.

Interest Rate

The interest rate is the percentage charged on the loan amount by the lenders from the borrowers. It is an important factor in deciding the nature of the loan and planning the EMI repayment effectively.

Loan Tenure

Loan tenure is the actual period of repayment of the borrowed amount. During the loan tenure, the borrower will make repayments in the form of Equated Monthly Instalments (EMI).

What is the Ideal Debt-to-Income Ratio?

The ideal debt-to-income ratio is 50%. Lenders generally consider this ratio when deciding on a loan application.

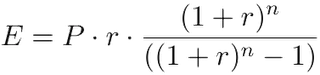

What is the Formula to Calculate the EMI Amount?

- E is EMI

- P is Principal Loan Amount

- r is rate of interest calculated on monthly basis.

- n is loan term / tenure / duration in number of months