![]()

Table of Contents

A personal loan is an unsecured loan that has gained tremendous popularity among salaried employees in India. Being unsecured, means you do not need to provide any collateral or security to avail of the loan. Whether for a family wedding, an unexpected medical emergency, or higher education, a personal loan is often the go-to solution for many salaried individuals. The flexibility, ease of application, and quick disbursement make it highly attractive for those needing urgent funds.

In today’s fast-paced world, salaried employees face various financial challenges, from meeting routine expenses to dealing with unforeseen situations. Personal loans help address these concerns efficiently. With the rise of digital banking and lending platforms like Kreditbazaar, applying for a personal loan has never been easier. The entire process can be done online, with minimal documentation, and in many cases, loan approval can happen within hours. This is especially helpful when time is of the essence, such as during a medical emergency or other urgent circumstances.

What makes personal loans even more appealing is their versatility. You can use the funds for virtually any purpose, whether it’s consolidating existing debts, paying for a vacation, renovating your home, or covering wedding expenses. Unlike other types of loans, personal loans come with flexible repayment options and competitive interest rates, making them manageable within a salaried employee’s monthly budget.

Why Salaried Employees in India Opt for Personal Loans

Flexibility and Convenience

One of the key reasons why personal loans have become a popular financial tool for salaried employees in India is their flexibility. Unlike loans that are tied to a specific purpose (like home loans or car loans), personal loans can be used for a variety of reasons. This flexibility gives salaried employees the freedom to allocate funds as per their financial needs. For instance, you might need money for a child’s education one month, and later for a home renovation project.

Moreover, the application process for personal loans is extremely convenient, especially with platforms like Kreditbazaar, where salaried individuals can apply online. All you need is basic documentation such as identity proof, address proof, and income details to get started. This ease of application, coupled with digital verification methods, has simplified the lending process.

No Need for Collateral or Security

Personal loans for salaried employees are unsecured, which means that there is no need to pledge any asset or collateral. This makes it accessible to a larger population who may not have valuable assets like property or gold to offer as security. The absence of collateral also means that you can apply for the loan without the fear of losing any asset in case of default.

For salaried employees, this provides a sense of security and peace of mind. You can borrow funds based on your creditworthiness, income stability, and repayment capacity rather than having to worry about securing the loan with an asset.

Quick Processing and Disbursement

One of the most significant advantages of personal loans for salaried employees is the quick processing and disbursement. Unlike other loans, where the process can take days or even weeks, personal loans are typically processed within hours to a couple of days. At Kreditbazaar, we ensure that our customers get pre-approved loans from our trusted lending partners and NBFCs, speeding up the approval process.

For salaried individuals, quick loan approval is crucial, especially when dealing with time-sensitive situations like medical emergencies or urgent home repairs. Most lenders offer instant approval and quick disbursal, directly crediting the loan amount into your bank account. This convenience has made personal loans a preferred choice for salaried employees across India.

Helps Manage Finances Without Affecting Monthly Budget

Salaried employees often have fixed monthly incomes, and any unforeseen expenses can strain their finances. A personal loan helps manage these additional costs without impacting the regular monthly budget significantly. With flexible repayment tenures and EMI options, personal loans allow salaried employees to repay the borrowed amount over a period that suits their financial situation.

In addition, many lenders offer pre-approved loan offers, which means that based on your existing credit profile and income, you can avail of a loan offer that is pre-qualified for you. This allows for smoother, faster approvals and disbursements. Moreover, personal loans often come with competitive interest rates, making it easier to repay the loan without overburdening yourself financially.

Eligibility Criteria for Personal Loans for Salaried Employees

Understanding the eligibility criteria for a personal loan is crucial for salaried employees seeking financial assistance. Here’s a detailed overview of the key requirements:

Employment Type

To qualify for a personal loan, salaried employees must typically be employed with:

- Private Limited Companies: Employees working in established private sector firms.

- Public Sector Employees: Those employed with public sector undertakings (PSUs).

- Government Employees: Individuals working with central or state government departments.

This broad eligibility range makes personal loans accessible to a significant portion of the salaried workforce in India. Banks and NBFCs prefer employees from these sectors due to their stable employment and regular income.

Age Criteria

The general age range for personal loan eligibility is:

- 21 to 60 Years Old: Applicants must be at least 21 years old at the time of applying and should not exceed 60 years of age. This age range ensures that borrowers are in a stable phase of their careers and are likely to have a consistent income.

Income Requirements

A minimum monthly salary requirement is usually set by lenders:

- ₹25,000 Per Month: Most banks and financial institutions require a minimum net monthly salary of ₹25,000. This threshold ensures that borrowers have the financial capacity to manage EMI payments comfortably.

Work Experience

Lenders require a certain level of job stability:

- Minimum 1 Year with Current Employer: Applicants should have been employed with their current employer for at least one year. This criterion helps lenders gauge job stability and financial reliability.

CIBIL Score

Your CIBIL score plays a significant role in the approval process:

- Minimum Score Required: Typically, a CIBIL score of 650 or above is considered good for personal loan approvals. A higher score improves your chances of getting a loan with favourable terms.

- Impact on Approval: A good CIBIL score reflects your creditworthiness and payment history. Lenders use this score to assess the risk of lending to you. A higher score generally leads to better loan offers and lower interest rates.

Geographical Criteria

Some banks have location-specific rules:

- Location-Specific Rules: Certain lenders may have specific criteria based on the applicant’s geographical location. For instance, loans might be offered only in certain cities or states where the bank has a strong presence or operational capacity.

Documents Required for Applying for a Personal Loan

To streamline the loan application process, you will need to provide the following documents:

Identity Proof

- PAN Card: A crucial document for identity verification and tax purposes.

- Aadhaar Card: An essential document for proof of identity and address.

- Passport: Used as a valid proof of identity and sometimes as address proof.

- Voter ID: Another form of identity verification accepted by many lenders.

Address Proof

- Utility Bills: Bills for electricity, water, or gas showing your address.

- Aadhaar Card: This can also serve as address proof.

- Rent Agreement: A valid rental agreement if you are living in a rented property.

- Passport: Sometimes used to confirm both identity and address.

Income Proof

- Salary Slips (Last Two Months): Recent salary slips provide proof of income and employment.

- Bank Statements (Previous 3 Months): Statements showing your salary credits and overall financial stability.

- Form 16: An annual tax document provided by your employer, showing total earnings and tax deductions.

Employment Proof

- Employment Certificate: A document from your employer confirming your employment status and tenure.

- Employer’s Letter: A letter from your employer detailing your position and salary, sometimes required for verification.

Photographs

- Passport-Sized Photos: Recent photographs are required for application processing and documentation.

Step-by-Step Process for Applying for a Personal Loan as a Salaried Employee

Applying for a personal loan can be a smooth process if you follow these detailed steps:

Step 1: Research and Compare Various Lenders

Choosing the right lender is crucial for securing a favourable loan. Here’s how to make an informed choice:

- Importance of Choosing the Right Bank or NBFC: Different lenders offer varying terms, interest rates, and loan features. Selecting the right institution can affect your loan’s cost and terms.

- Factors to Consider:

- Interest Rate: Compare the annual percentage rates (APR) offered by different lenders. A lower interest rate will reduce your overall repayment amount.

- Loan Tenure: Check the available loan tenures and choose one that aligns with your repayment capacity.

- Processing Fees: Some lenders charge processing fees, which can add to the total cost of the loan. Ensure you understand these fees before applying.

Step 2: Check Eligibility and Gather Documents

Before applying, confirm your eligibility to streamline the process:

- Importance of Eligibility Check Using Online Tools: Many banks and NBFCs provide online eligibility calculators. Use these tools to assess whether you meet the requirements before applying.

- Gather Required Documents: Prepare all necessary documents such as identity proof, address proof, income proof, employment proof, and photographs to avoid delays.

Step 3: Fill Out the Loan Application Form

The application process can be completed online or offline:

- Online vs Offline Application Methods:

- Online Application: This is the most convenient method. Visit the lender’s website or use their app to fill out the form.

- Offline Application: Visit the bank branch to fill out the form manually.

- Tips for Filling the Form Accurately:

- Provide Correct Information: Ensure all personal, financial, and employment details are accurate to avoid application rejections or delays.

- Double-Check Entries: Review your application form for any errors or omissions before submission.

Step 4: Submit the Required Documents

After completing the application form, submit the required documents:

- How to Upload Documents Online: Most lenders have a secure portal where you can upload scanned copies of your documents. Ensure that all files are clear and legible.

- Submit Documents to the Bank Branch: If applying offline, hand over the documents to the bank’s loan officer.

- Verification Process by the Lender: The lender will verify your documents to confirm their authenticity and your eligibility for the loan.

Step 5: Approval and Disbursement of Loan

Once your documents are verified, the final steps are:

- Time Taken for Loan Approval: Loan approval time can vary but typically ranges from a few hours to several days, depending on the lender and the completeness of your application.

- How Loan Amount is Credited to Your Bank Account: Upon approval, the loan amount is disbursed and credited directly to your bank account. You will receive a notification regarding the disbursement.

Looking for an instant personal loan? Apply now with minimal documentation and get approval in just 24 hours! Don’t miss out on the best personal loan offers for salaried employees from trusted NBFCs and banks. Contact Kreditbazaar today to find the perfect loan solution for your financial needs!

How to Improve Your Chances of Loan Approval

Enhancing your chances of loan approval involves addressing key factors that lenders consider:

Maintain a Good CIBIL Score

- Tips on Improving Credit Score:

- Check Your Credit Report Regularly: Review your credit report for any errors and resolve them promptly.

- Pay Bills on Time: Timely payment of credit card bills and other loans positively impacts your score.

- Reduce Debt: Lowering your existing debt levels can improve your credit score and make you a more attractive borrower.

Accurate Documentation

- Ensuring All Documents are Updated and Correct:

- Verify Document Details: Ensure that all documents are current and accurately reflect your personal and financial information.

- Keep Records Organized: Have your documents organized to streamline the submission process and avoid any issues.

Stable Employment Record

- Importance of Job Stability for Lenders:

- Show Consistency: A stable employment record indicates reliability and a steady income source, which lenders favour.

- Provide Proof of Employment: Submit recent employment certificates or letters confirming your job tenure and stability.

Consider a Co-Applicant

- Benefits of Adding a Co-Applicant with a Higher Salary:

- Strengthen Application: A co-applicant with a higher salary or better credit score can enhance your loan application and improve approval chances.

- Shared Responsibility: Both applicants share responsibility for the loan, which can be advantageous for securing better terms.

Loan Amount Based on Repayment Ability

- Opt for a Loan That Fits Your Budget:

- Assess Your Repayment Capacity: Choose a loan amount and tenure that you can comfortably manage within your monthly budget to avoid default.

- Avoid Over-Borrowing: Applying for a loan amount beyond your capacity can lead to rejection and financial strain.

What to Expect After Loan Application

Once you have submitted your application for a personal loan, several steps follow before you receive the funds. Here’s what you can expect during this process:

Loan Processing Time

- Average Time for Approval and Disbursement: The time taken for loan approval can vary between lenders but typically ranges from a few hours to a few days. The processing time depends on the lender’s internal procedures, the completeness of your application, and the verification of your documents.

- Factors Influencing Processing Time: Delays can occur due to incomplete documentation, additional verification requirements, or high loan volumes. Ensuring all required documents are accurate and complete can expedite the process.

Verification Calls

- Bank’s Process of Verifying Details with Your Employer: Lenders may conduct verification calls to confirm your employment details and income. This step helps in validating the information provided in your application.

- Purpose of Verification Calls: The bank wants to ensure that you are employed with the stated organization and that your income details are correct. This is a standard procedure to reduce the risk of loan defaults.

Loan Disbursement

- How Long It Takes to Get the Loan Credited to Your Bank Account: Once your loan is approved, the disbursement process typically takes from a few hours to a couple of days, depending on the lender and the method of disbursement.

- Mode of Disbursement: The loan amount is usually credited directly to your bank account. You will receive a confirmation notification once the funds are transferred.

Loan Agreement

- Key Points to Look Out For in the Agreement:

- Interest Rate: Check the annual percentage rate (APR) to understand the cost of borrowing.

- Repayment Schedule: Review the EMI schedule and due dates to plan your payments.

- Prepayment Clauses: Understand the terms related to prepayment or partial prepayment. Some lenders may charge a fee for early repayment or offer discounts for prepaying.

Common Mistakes Salaried Employees Should Avoid When Applying for a Personal Loan

Avoiding common pitfalls can enhance your chances of securing a loan and ensure a smooth borrowing experience:

Ignoring CIBIL Score

- How a Low Credit Score Affects Your Application: A low CIBIL score can lead to loan rejection or unfavourable terms. Lenders use your credit score to assess your creditworthiness and risk of default.

- Improving Your Score: Regularly check your credit report and address any issues. Ensure timely payment of existing loans and credit card bills to maintain a healthy score.

Choosing the Wrong Lender

- Pitfalls of Not Comparing Interest Rates and Terms: Failing to compare offers from different lenders can result in higher interest rates and less favourable loan terms. It’s crucial to research and choose a lender that offers competitive rates and flexible terms.

- Using Comparison Tools: Leverage online tools and resources to compare rates and features of various lenders to make an informed decision.

Applying for Multiple Loans

- Why Applying for Several Loans at Once Lowers Your Credit Score: Applying for multiple loans can negatively impact your credit score, as it may be seen as a sign of financial distress. Each loan application results in a hard inquiry on your credit report.

- Better Approach: Apply for one loan at a time and ensure you meet the eligibility criteria before applying to avoid multiple rejections.

Misunderstanding Loan Terms

- Importance of Understanding Interest Rates, Hidden Fees, and Prepayment Penalties: Not fully understanding the terms of your loan can lead to unexpected costs. Review the loan agreement carefully to understand the interest rate, any additional fees, and penalties for early repayment.

- Clarify Ambiguities: If any terms are unclear, seek clarification from the lender before signing the agreement.

How to Calculate EMI for Personal Loans for Salaried Employees

Calculating your Equated Monthly Installment (EMI) is essential for planning your loan effectively. EMI ensures that your loan repayment is spread out evenly over the loan tenure, making it easier to manage within your monthly budget.

What is an EMI (Equated Monthly Installment)?

An EMI is the fixed monthly amount that a borrower needs to pay to the lender. It includes both the principal loan amount and the interest. The total loan amount and interest are divided over the repayment period in such a way that you pay a fixed amount each month.

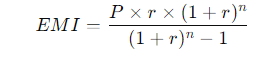

EMI Formula

EMI is calculated using the following standard formula:

Where:

- P = Principal loan amount

- r = Monthly interest rate (annual interest rate divided by 12)

- n = Loan tenure in months

For example, if you take a personal loan of ₹5,00,000 at an annual interest rate of 10% for a tenure of 3 years (36 months), your EMI would be calculated as follows:

- P = ₹5,00,000

- r = 10/12/100 = 0.00833 (monthly interest rate)

- n = 36 months

Using the formula, you can calculate the EMI, which will give you a fixed amount to pay each month until the loan is fully repaid.

Online EMI Calculator Tools

To simplify the process, you can use online EMI calculators. Most banks and NBFCs provide free EMI calculators on their websites. These tools are user-friendly and allow you to quickly estimate your monthly EMI without manual calculations.

How to Use an Online EMI Calculator:

- Input Loan Amount (Principal): Enter the amount you wish to borrow, for example, ₹5,00,000.

- Enter Interest Rate: Provide the interest rate offered by your lender, e.g., 10%.

- Select Loan Tenure: Choose the tenure, such as 3 years (36 months).

- Click Calculate: The tool will immediately show the EMI amount, along with details of the total interest payable and the overall cost of the loan.

Advantages of Using EMI Calculators:

- Time-Saving: You don’t need to manually calculate complex interest formulas.

- Accurate Estimates: These tools give precise EMI figures based on the input data.

- Helps with Loan Planning: By adjusting the loan amount, tenure, or interest rate, you can find an EMI that fits your budget.

Factors Affecting EMI

Several key factors determine your EMI amount. Understanding these can help you make informed decisions while taking a personal loan.

1. Loan Amount (Principal)

The higher the loan amount, the higher your EMI will be. For example, a loan of ₹10,00,000 will have a higher EMI than a loan of ₹5,00,000, assuming the same interest rate and tenure.

2. Interest Rate

The interest rate directly influences the EMI. A higher interest rate will increase the monthly repayment amount. For instance, a loan at 12% interest will have a higher EMI than one at 10%. Salaried employees can often benefit from competitive rates by maintaining a good credit score.

3. Loan Tenure

The tenure (or repayment period) is the length of time over which you repay the loan. A longer tenure reduces the EMI but increases the total interest paid over time. Conversely, a shorter tenure increases the EMI but lowers the total interest payable.

- Longer Tenure: Lower EMI but higher total interest.

- Shorter Tenure: Higher EMI but lower total interest.

Examples to Illustrate Different EMI Scenarios:

- For a Loan of ₹5,00,000 at 10% for 3 years:

- Monthly EMI: ₹16,134

- Total interest paid over tenure: ₹80,840

- Total cost of the loan: ₹5,80,840

- For the Same Loan but at 12% for 3 years:

- Monthly EMI: ₹16,607

- Total interest paid over tenure: ₹97,854

- Total cost of the loan: ₹5,97,854

This illustrates how a slight increase in interest rate can significantly impact the overall cost of the loan and monthly EMI.

Importance of Choosing the Right EMI Plan

Financial Planning:

Selecting the right EMI plan is critical to avoiding financial stress. Ensure that your EMI doesn’t consume too much of your monthly salary, ideally keeping it below 40% of your income to manage other expenses comfortably.

Balancing EMIs and Expenses:

If your EMI is too high, you may struggle with monthly payments, leading to missed payments and penalties. Conversely, if your EMI is too low, you may end up paying significantly more in interest over the loan tenure. It’s crucial to strike a balance between an affordable EMI and the total cost of the loan.

Customizing Your EMI:

Many banks and NBFCs offer flexible EMI plans. You can opt for step-up EMIs (lower EMI in the beginning, increasing over time) or step-down EMIs (higher EMI in the beginning, reducing over time) depending on your financial situation. These options help you better manage your finances and align repayments with expected salary increments or other income changes.

Best Banks and NBFCs for Personal Loans for Salaried Employees in India

When it comes to personal loans for salaried employees, several banks and NBFCs offer attractive options. Each financial institution provides its own set of interest rates, repayment options, and eligibility criteria, making it essential to compare and choose the one that suits your needs best. Here’s a detailed look at some of the top lenders:

State Bank of India (SBI)

SBI is one of the most trusted names in the Indian banking sector. The bank offers competitive interest rates and flexible repayment options for salaried employees.

- Interest Rates: SBI’s personal loan interest rates typically range from 10.90% to 12.60% per annum.

- Loan Tenure: You can choose a repayment tenure between 12 to 60 months.

- Eligibility Criteria: SBI offers loans to salaried individuals working in government or reputed private institutions. The minimum salary required is ₹25,000 per month.

Special Features:

- SBI offers a balance transfer option, allowing you to transfer your high-interest loan from another lender to SBI at a lower interest rate.

- Minimal documentation is required, and salaried employees can benefit from quick approval and disbursement.

HDFC Bank

HDFC Bank is known for providing special offers and fast personal loan processing for salaried employees.

- Interest Rates: Starting from 10.50% per annum, the rates can vary based on your credit profile and employer.

- Loan Tenure: HDFC offers tenures from 12 to 60 months.

- Eligibility Criteria: Salaried employees from private limited companies, public sector undertakings, and government organizations are eligible.

Special Features:

- HDFC offers special discounts and lower interest rates for employees of reputed companies.

- The bank provides flexible repayment options, including step-up EMIs and the ability to make part-prepayments without penalties.

ICICI Bank

ICICI Bank is known for its fast approval process and easy online application system for personal loans.

- Interest Rates: Ranging between 10.50% to 13.25% per annum.

- Loan Tenure: Repayment periods of up to 60 months.

- Eligibility Criteria: Salaried individuals earning a minimum of ₹25,000 per month are eligible.

Special Features:

- ICICI offers instant approval of loans if you meet the eligibility criteria.

- The entire loan process, from application to disbursement, can be completed online, making it extremely convenient for salaried employees.

Bajaj Finserv

Bajaj Finserv is a leading NBFC in India, known for offering fast and hassle-free personal loans with minimal documentation.

- Interest Rates: Starting from 12% per annum.

- Loan Tenure: Flexible repayment tenure ranging from 12 to 84 months.

- Eligibility Criteria: Salaried employees with a minimum salary of ₹30,000 are eligible.

Special Features:

- Bajaj Finserv offers quick loan disbursement within 24 hours of approval.

- You can also benefit from pre-approved loan offers, especially if you have a good credit score.

Axis Bank

Axis Bank offers competitive interest rates and a range of flexible options for salaried employees.

- Interest Rates: Starting from 10.49% per annum.

- Loan Tenure: Tenure options from 12 to 60 months.

- Eligibility Criteria: Salaried employees working in MNCs, government, and private limited companies are eligible.

Special Features:

- Axis Bank provides top-up loans for existing borrowers.

- The bank offers balance transfer facilities with lower interest rates, making it easier for you to switch loans.

Kotak Mahindra Bank

Kotak Mahindra Bank is known for its fully digital loan process and customer-friendly policies.

- Interest Rates: Ranging from 10.50% to 15% per annum.

- Loan Tenure: Repayment tenure of up to 60 months.

- Eligibility Criteria: Salaried employees with a minimum monthly salary of ₹25,000 are eligible.

Special Features:

- Kotak Mahindra Bank offers zero prepayment charges, allowing you to pay off your loan early without penalties.

- The entire loan application process is digital, making it fast and easy for salaried employees.

Personal Loan Interest Rates for Salaried Employees

Interest rates on personal loans for salaried employees vary widely across banks and NBFCs. Understanding these rates and the factors that influence them is crucial in securing the best possible deal.

Average Interest Rates in 2024 for Salaried Employees in India

As of 2024, the average personal loan interest rates for salaried employees in India range from 10.50% to 15% per annum. The specific rate you receive depends on your financial profile, including your income, employment status, and credit score.

Here are a few interest rate examples:

- SBI: 10.90% to 12.60% p.a.

- HDFC Bank: 10.50% onwards.

- ICICI Bank: 10.50% to 13.25% p.a.

- Bajaj Finserv: Starting at 12% p.a.

- Axis Bank: 10.49% onwards.

Factors Affecting Interest Rates

1. CIBIL Score

Your CIBIL score is one of the most critical factors that determine the interest rate. A high CIBIL score (750 and above) usually qualifies you for lower interest rates, while a low score may lead to higher rates or even loan rejection.

2. Employment Type

Banks and NBFCs tend to offer lower interest rates to salaried employees working for reputed companies, MNCs, or government organizations. Private-sector employees may face slightly higher interest rates compared to public-sector employees.

3. Loan Amount and Tenure

A higher loan amount may result in lower interest rates, while a shorter tenure often results in higher EMIs but lower overall interest payable.

Fixed vs Floating Interest Rates: What’s Better for Salaried Employees?

Fixed Interest Rate

A fixed interest rate remains the same throughout the loan tenure, offering predictable EMI payments. This is a good option if you prefer stability in your financial planning.

Floating Interest Rate

A floating rate changes according to market fluctuations, which means your EMI may increase or decrease over time. This option may offer lower rates initially but carries the risk of rising interest costs later.

For salaried employees, fixed interest rates are generally preferable for long-term planning, while floating rates may work well for shorter loans if you expect interest rates to drop.

Tips to Negotiate a Lower Interest Rate

- Improve Your CIBIL Score: A CIBIL score above 750 can help you secure lower interest rates.

- Compare Multiple Lenders: Don’t settle for the first offer. Compare the interest rates, processing fees, and loan terms of different lenders.

- Leverage Employer Relationships: Some banks offer special rates for employees of reputed companies. Check if your employer has a tie-up with any bank or NBFC.

- Choose a Shorter Tenure: If possible, opt for a shorter tenure to reduce the total interest payable, though your EMI might be slightly higher.

By carefully selecting the right bank or NBFC and negotiating your interest rate, you can ensure that you get the best personal loan deal as a salaried employee. Kreditbazaar offers pre-approved personal loans through its NBFC partners, helping salaried employees secure loans with competitive rates and flexible repayment options.

Conclusion

In summary, applying for a personal loan as a salaried employee in India is a straightforward process, especially with the rise of digital banking. We’ve walked through the key steps — from understanding eligibility criteria to preparing the necessary documents, comparing various lenders, and choosing the best loan based on factors like interest rates and repayment terms.

Salaried employees benefit from the flexibility, ease of application, and quick processing that personal loans offer, making them ideal for managing unexpected expenses such as medical emergencies, weddings, or educational costs. It’s important to do your due diligence: compare various banks and NBFCs, understand the terms and conditions, and select the loan that best suits your financial needs and repayment capacity. A bit of research can help you save significantly on interest rates and other loan-related charges.

At Kreditbazaar, we provide pre-approved personal loans through our lending partners, ensuring you get competitive interest rates and minimal documentation requirements.