![]()

The SBI E-Mudra Loan 50000 is an excellent financial solution for micro and small business owners in India. Offered under the Pradhan Mantri MUDRA Yojana (PMMY), this loan helps budding entrepreneurs kickstart or expand their businesses without the need for collateral. In this guide, we break down everything you need to know in simple, easy English.

Table of Contents

What Is Pradhan Mantri MUDRA Yojana (PMMY)?

Launched by the Hon’ble Prime Minister on April 8, 2015, the PMMY is a government initiative aimed at providing loans up to Rs.10 lakh to non-corporate, non-farm small and micro enterprises. The scheme is designed to boost business activities in the manufacturing, trading, services, and allied agricultural sectors. Loans under PMMY are offered by a variety of institutions, including Commercial Banks, Regional Rural Banks (RRBs), Small Finance Banks, Cooperative Banks, Micro Finance Institutions (MFIs), and Non-Banking Financial Companies (NBFCs).

Loan Categories Under PMMY

Under the PMMY, loans are divided into three categories based on the growth stage and funding needs of the business:

- Shishu: Loans up to Rs 50,000

Ideal for start-ups and early-stage businesses. - Kishore: Loans from Rs 50,001 to Rs 500,000

Suitable for businesses looking to expand their operations. - Tarun: Loans from Rs.500,001 to Rs.10,00,000

For more established businesses aiming at capacity expansion or modernisation.

The SBI E-Mudra Loan 50000 specifically falls under the Shishu category, targeting new and small business ventures.

Eligibility Criteria for SBI e-MUDRA loan of 50,000 INR

To be eligible for the SBI e-MUDRA loan of 50,000 INR, the following criteria must be met:

- Existing Customer Status: Applicants must have an existing savings bank or current account with SBI.

- Age Requirement: The applicant should be between 18 and 60 years old.

- Account Activity: The account must have been active for a minimum of 6 months.

- For Non-Existing Customers: Those without an SBI account can apply through the nearest branch or the JanSamarth portal at www.jansamarth.in, though the online e-MUDRA facility is reserved for existing customers.

These criteria ensure that the loan is accessible to a broad range of micro-entrepreneurs, particularly those already banking with SBI, facilitating a seamless digital application process.

People also read: Can you get a 50000 INR Loan without a CIBIL Score?

Key Features of the SBI E-Mudra Loan 50000

1. Nature of Facility and Purpose

- Facility Type: Working Capital and Term Loan

- Purpose:

- Business purposes, such as starting or running a business

- Capacity expansion and modernisation

2. Target Group

- The loan is meant for enterprises in the manufacturing, trading, and services sectors, including allied agricultural activities. This makes it ideal for a wide range of small and micro businesses across India.

3. Loan Amount and Margin

- Maximum Loan Amount: Up to Rs 10 lakh

- For Shishu (Loans up to Rs 50,000):

- Margin: Nil

- Margin: Nil

- For Higher Categories (Kishore and Tarun):

- Margin: 20% (for loans ranging from Rs 50,001 to Rs 10 lakh)

4. Pricing and Fees

- Pricing: Competitive and linked to the External Benchmark Lending Rate (EBLR)

- Processing Fee:

- Shishu and Kishore: Nil for Micro and Small Enterprises (MSE)

- Tarun: 0.50% (plus applicable tax) of the loan amount

- Shishu and Kishore: Nil for Micro and Small Enterprises (MSE)

5. Repayment Period

- For Loans below Rs 5 lakh:

- Up to 5 years, including a moratorium period of up to 6 months

- Up to 5 years, including a moratorium period of up to 6 months

- For Loans from Rs 5 lakh to Rs 10 lakh:

- Up to 7 years, including a moratorium period of up to 12 months

Step-by-Step Application Process to Apply for the SBI E-Mudra Loan 50000

Below is a step-by-step guide to applying for the SBI E-Mudra Loan (₹50,000) with Screenshots to guide you better and make the application process easier for you.

1. Visit the Jansamarth Portal

- Note: SBI does not provide the online e-Mudra loan directly through their website. Instead, you need to use the Jansamarth website.

- How to Start:

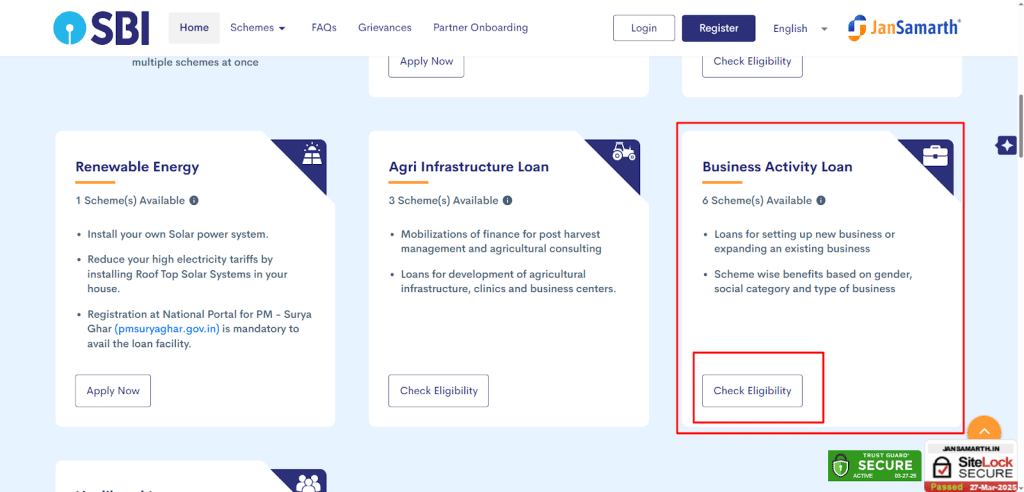

Go to Jansamarth SBI Page. Here, you will see different loan options. Choose “Business Activity Loan” and click on “Check Eligibility.”

2. Eligibility Check Process

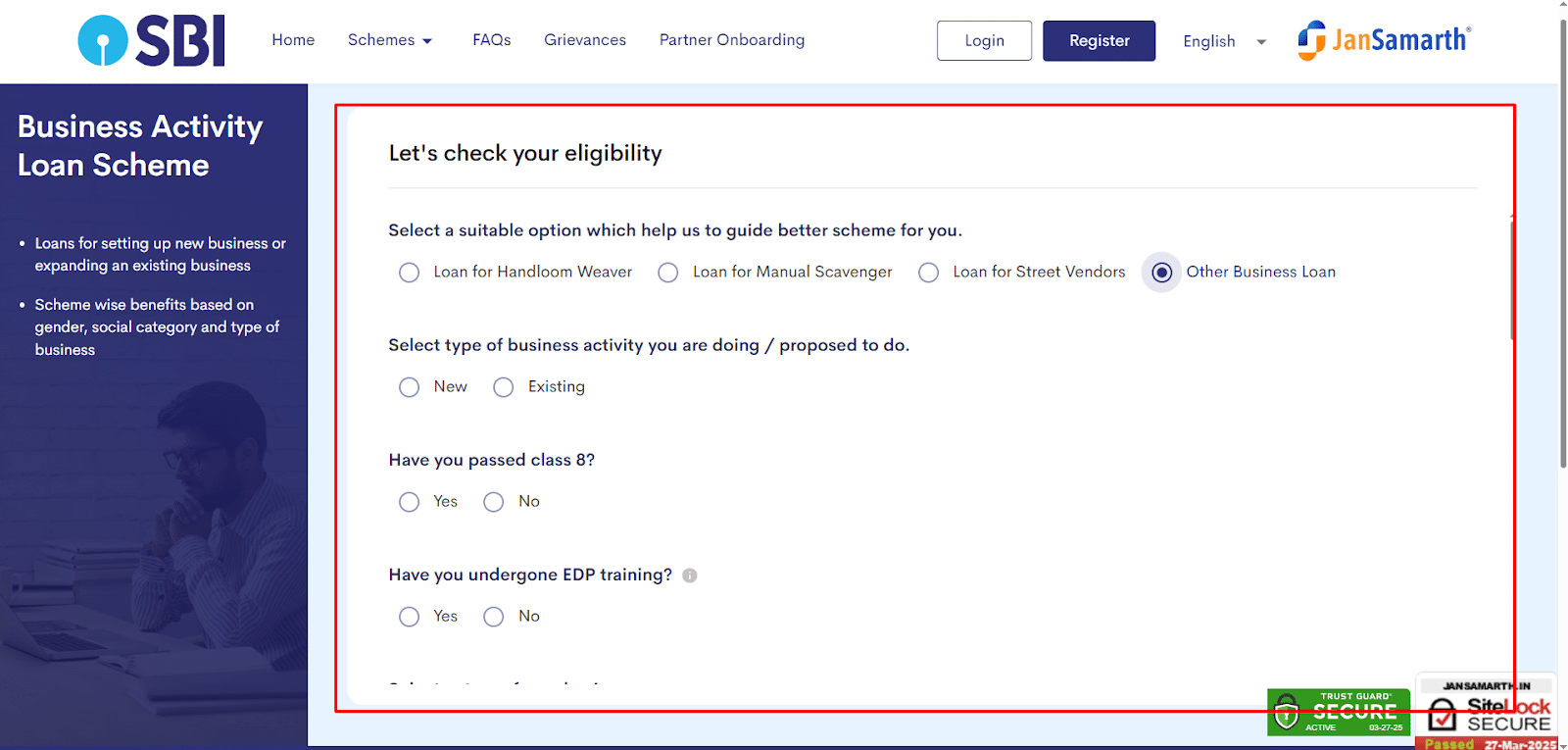

After clicking on “Check Eligibility,” you will be redirected to the Eligibility Check page. Here, you need to fill in details based on your business and personal profile:

Step 2.1: Business Activity

- Options:

- New: If your business is new.

- Old: If your business is already established.

- New: If your business is new.

Step 2.2: Educational Qualification

- Question: Have you passed Class 8?

- Yes: If you have passed Class 8.

- No: If you have not passed Class 8.

- Yes: If you have passed Class 8.

Step 2.3: Entrepreneur Development Program (EDP) Training

- Question: Have you undergone EDP training?

- Yes: If you have taken the Entrepreneur Development Program (offered by an institution or the government).

- No: If you have not undergone the training.

- Yes: If you have taken the Entrepreneur Development Program (offered by an institution or the government).

Step 2.4: Nature of Business

- Options:

- Manufacturing

- Business/Service

- Trading

- Manufacturing

Step 2.5: Personal Details

- Select Your Gender:

- Male, Female, or Other.

- Male, Female, or Other.

- Select Your Social Category:

- General, OBC, SC/ST, or Minority.

- General, OBC, SC/ST, or Minority.

- Ex-Serviceman/Physically Handicapped:

- Yes or No.

- Yes or No.

Step 2.6: Geographical Location

- Special Regions Check:

Answer whether your business is located in:- North East Region,

- States of Uttarakhand, Himachal Pradesh, Jammu & Kashmir,

- Andaman & Nicobar Islands & Lakshadweep Islands,

- Hilly Areas, Tribal Areas, or Border Areas.

- Response: Yes or No.

- North East Region,

- General Location:

- Urban or Rural.

- Urban or Rural.

Step 2.7: Applicant Type

- Options:

- Individual

- Non-individual

- Individual

Step 2.8: Project and Loan Details

- Estimated Project Cost:

Enter the overall project cost (e.g., ₹50,000). - Your Investment:

Enter the amount you plan to invest from your source. (Enter Zero [0] if you need the full loan.) - Loan Amount Needed:

Enter the loan amount you need (for example, ₹50,000 for the SBI E-Mudra Loan).

People also read: Is getting a 50000 INR Loan without a Salary slip possible?

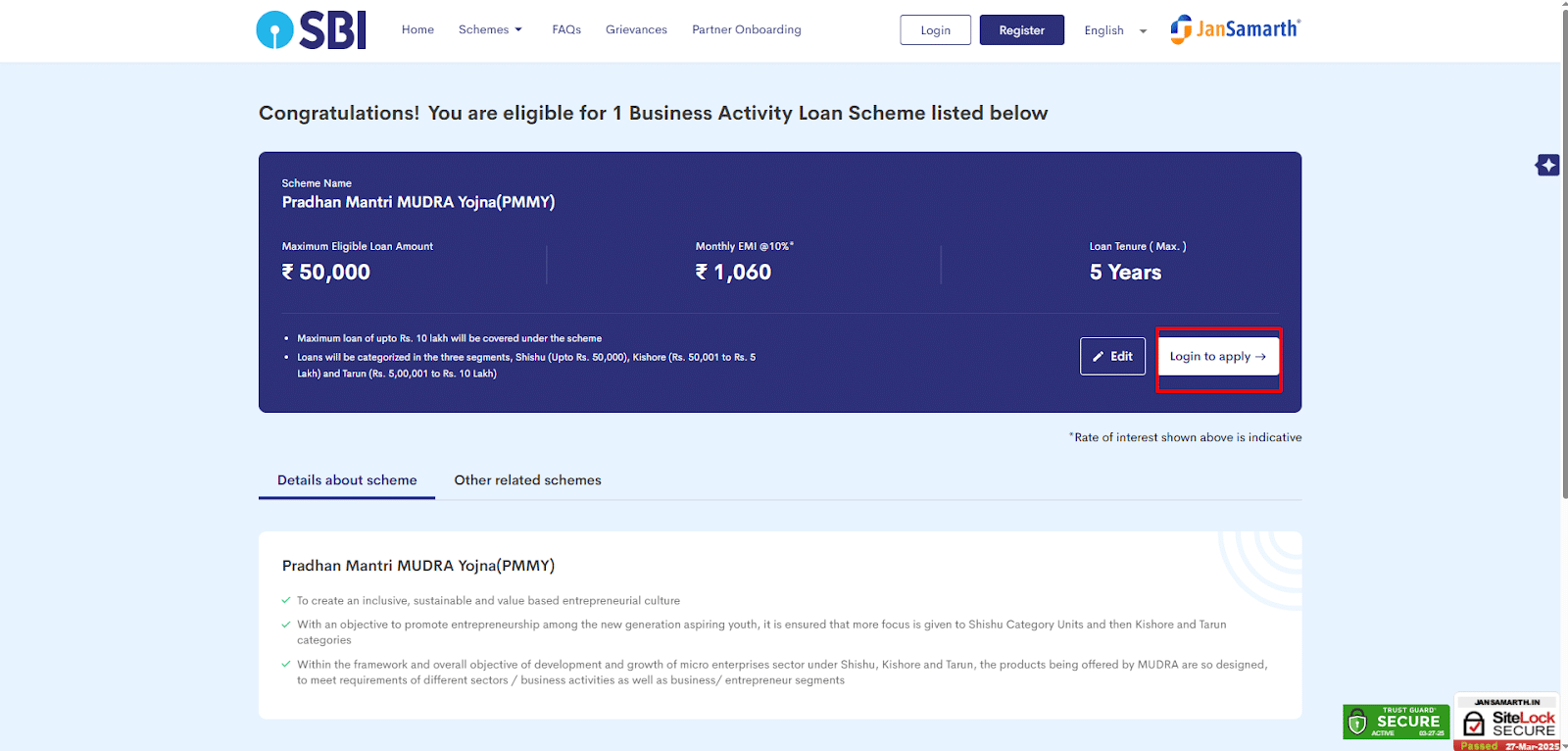

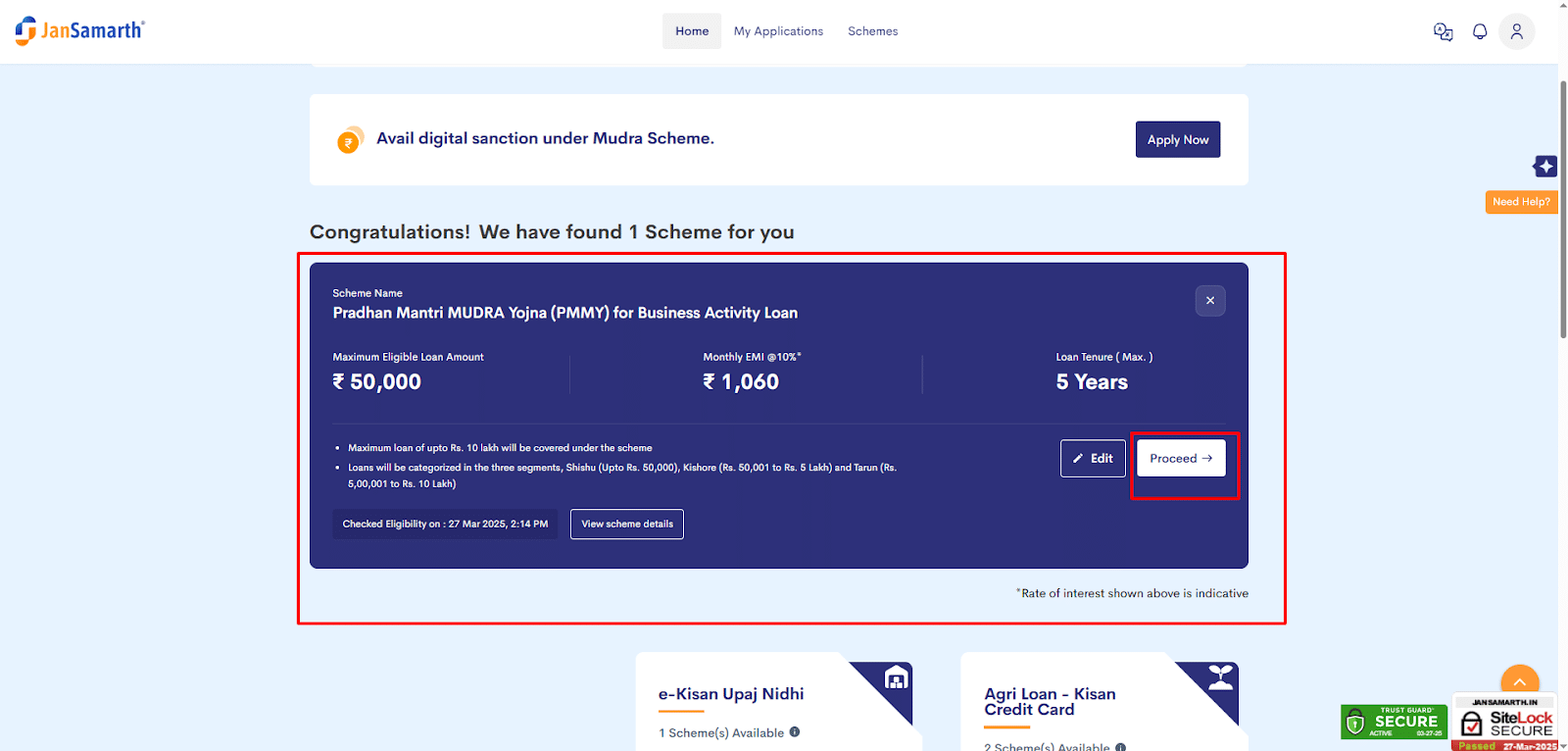

3. Review Loan Offer

- After completing the eligibility form, you will see a “Congratulations” page displaying your loan offer, including the interest rate and tenure.

- Next Step:

Before applying, you must log in or register if you are a new user. Click the “Login to apply” button to proceed.

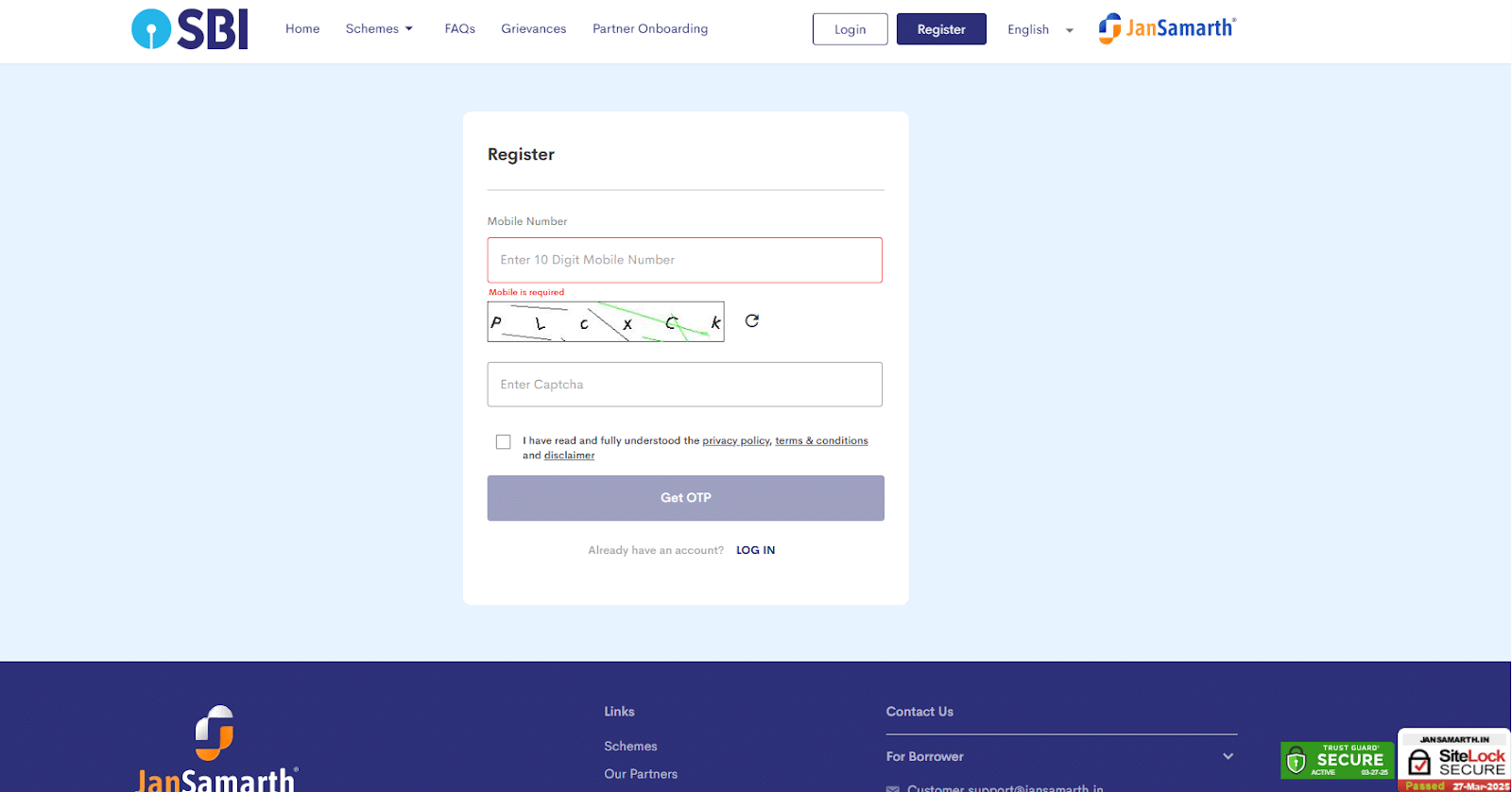

4. Registration/Login Process

- How It Works:

- You will see a registration/login page where you need to enter your mobile number.

- Complete the captcha and agree to the terms and conditions.

- Click on “Get OTP”. An OTP will be sent to your mobile number.

- You will see a registration/login page where you need to enter your mobile number.

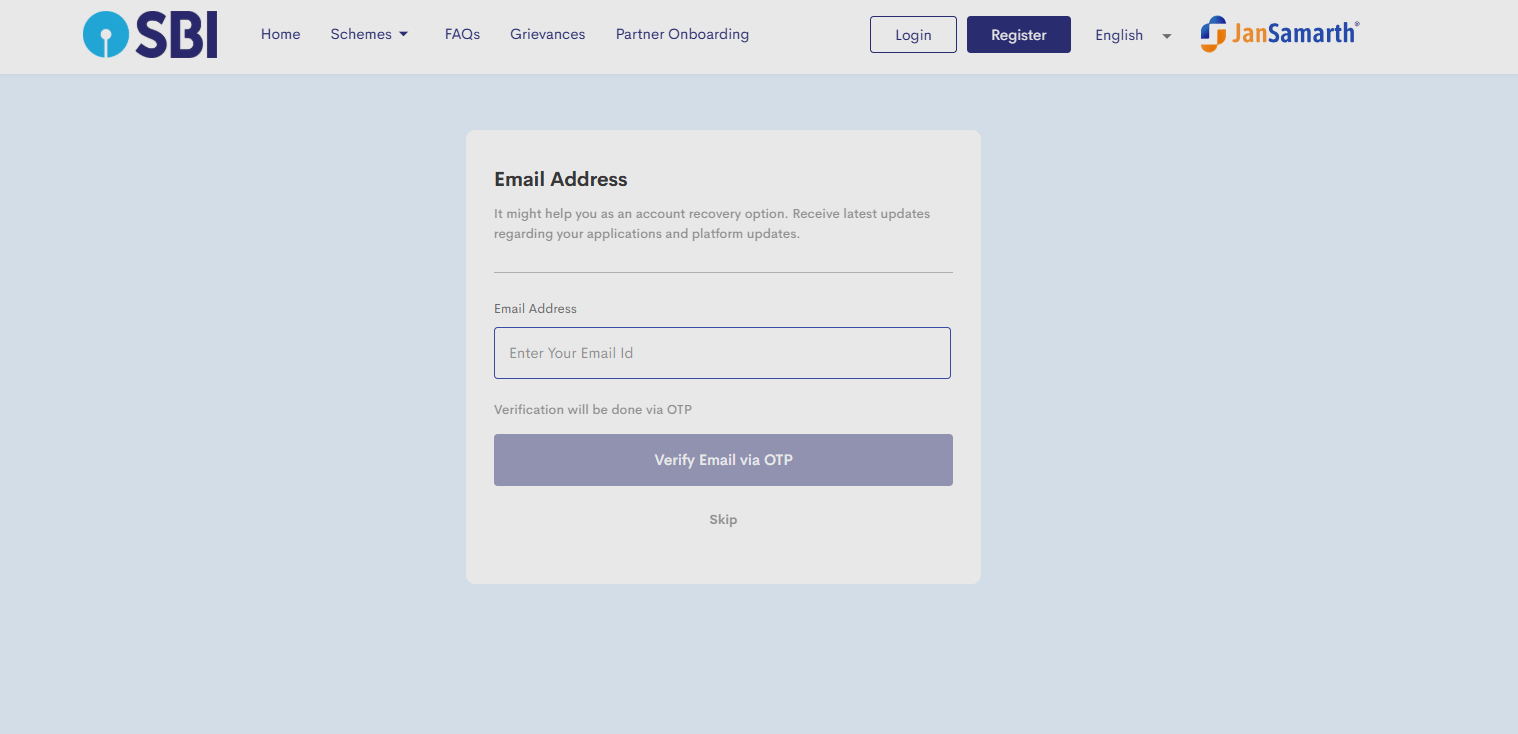

- Email Update:

You can add your email address to receive updates about your application process. Verify the email with the OTP sent.

5. Access Your Dashboard

- Once registered, you will be redirected to your dashboard (Dashboard Link).

- Dashboard Features:

- You can view your loan offer.

- You have the option to “Proceed” with your application or “Edit” your information if needed.

- You can view your loan offer.

People also read: Documents needed for a 50000 INR Loan

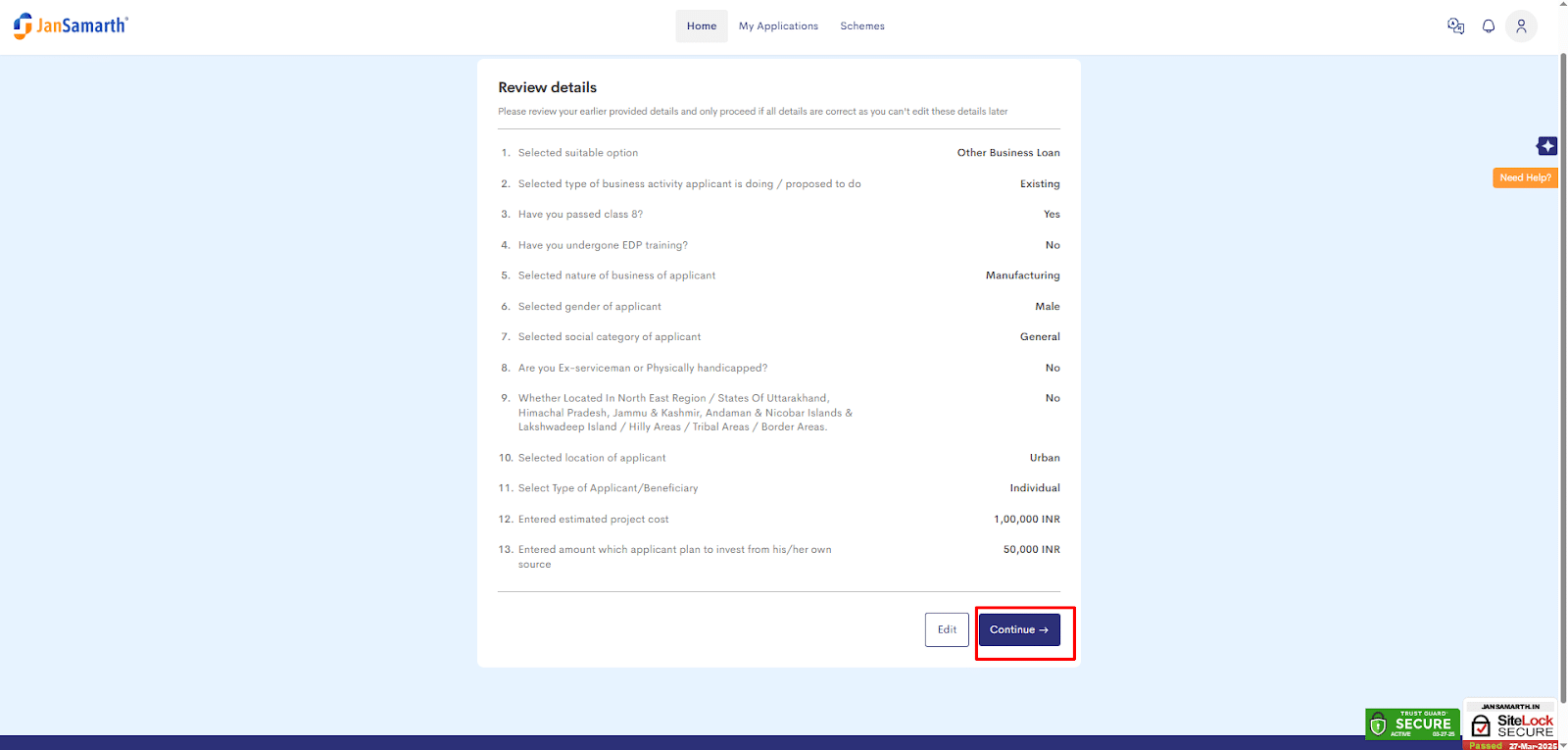

6. E-Mudra Loan Application Page

- Click on “Proceed” to go to the E-Mudra loan application page.

- Review Your Details:

- Carefully check and edit your information if any corrections are needed.

- When everything is correct, click on “Continue”.

- Carefully check and edit your information if any corrections are needed.

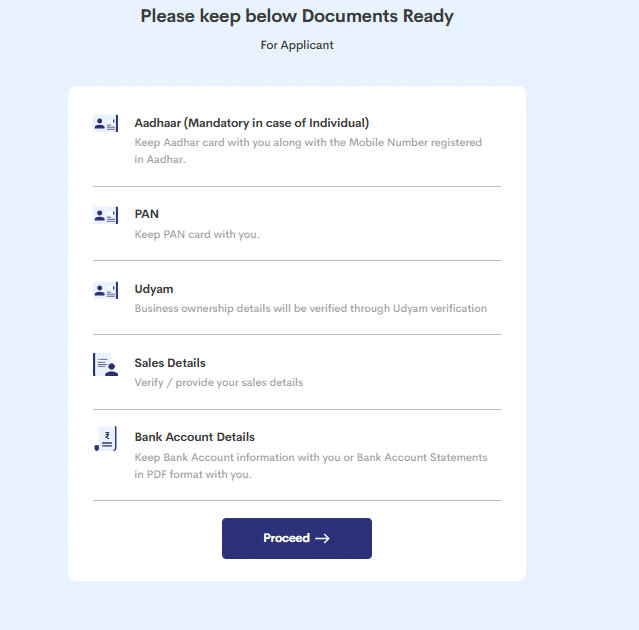

7. Document Preparation and Final Steps

- Important Documents:

Before moving ahead, make sure you have the following documents ready:- Aadhaar (Mandatory for individuals)

- PAN Card

- Udyam Registration

- Sales Details

- Bank Account Details

- Aadhaar (Mandatory for individuals)

- Further Steps:

- After the document section, there are 12 additional steps. These include:

- Identity Verification

- GSTIN List Details

- GST Details

- Income Details

- Bank Account Details

- Business Details

- Associate Concern Details

- Business Loan Details

- Existing Credit Details

- Upload Documents

- Application Review

- Bank Selection

By following all these steps, you can successfully apply for an SBI E-Mudra Loan of ₹50,000.

Benefits of the SBI E-Mudra Loan 50000

- Quick and Easy Approval: A streamlined application process minimises paperwork and speeds up approval.

- No Collateral Required: As an unsecured loan, there is no need to pledge any assets.

- Business Growth: Access the funds you need to start or expand your business.

- Flexible Repayment Options: Choose a repayment schedule that suits your business’s cash flow.

- Trusted Banking Partner: SBI’s extensive network and reputation provide additional assurance to borrowers.

EMI Calculation for SBI E-Mudra Loan 50000

To calculate the Equated Monthly Instalment (EMI) for the loan, borrowers can use the formula:

The EMI (Equated Monthly Installment) formula is EMI = [P x R x (1+R)^N] / [(1+R)^N – 1]

Where:

- P is the principal amount (50,000 INR).

- R is the monthly interest rate (annual rate divided by 12 and then by 100, e.g., 8.40% becomes 0.007 per month).

- N is the number of monthly instalments (e.g., 60 for 5 years).

For example, for a 50,000 INR loan at 8.40% p.a. over 5 years:

- R=8.40/12/100=0.007 R = 8.40/12/100 = 0.007 R=8.40/12/100=0.007

- N=60 N = 60 N=60

- EMI ≈ 1,019 INR per month.

Alternatively, borrowers can use online EMI calculators available on our website for precise calculations, ensuring transparency in financial planning.

Recent Updates and Context

As of March 27, 2025, there are no specific updates mentioned in the research for the e-MUDRA loan, but the PMMY scheme continues to evolve, with recent budget announcements increasing loan limits to 20 lakh INR for certain categories, though e-MUDRA remains focused on up to 50,000 INR for instant loans. This ensures continuity for small-scale borrowers seeking quick funding.

Conclusion

SBI E-Mudra Loan 50000 is a must for new and small business owners in India. With an unsecured loan at competitive rates, flexible repayment options and an easy application process, it helps entrepreneurs to grow and modernise their business. Whether you are starting a new business or looking to expand an existing one, this loan under PMMY can fulfil your financial needs.

For more details or to apply now, visit the SBI Mudra Loan website.

Frequently asked questions (FAQs)

1. What is the SBI E-Mudra Loan?

- The SBI E-Mudra Loan is a financial product offered by the State Bank of India under the Pradhan Mantri MUDRA Yojana (PMMY). It provides micro and small enterprises with loans up to ₹50,000 to support business activities, capacity expansion, and modernisation.

2. Who is eligible to apply for the SBI E-Mudra Loan?

- Micro-entrepreneurs who have an existing SBI savings or current account for at least six months are eligible to apply. The business should be engaged in manufacturing, trading, services, or allied agricultural activities.

3. How can I apply for the SBI E-Mudra Loan?

- Applicants can apply online through the Jansamarth Portal. The process involves checking eligibility, registering or logging in, and completing the application form with the necessary details and documents.

4. What documents are required for the application?

- The required documents include:

- SBI savings or current account number and branch details.

- Business proof (name, start date, and address).

- Aadhaar number linked with a mobile number for e-KYC and e-Sign.

- Community details (General/ST/OBC/SC/Minority).

- GSTN and Udyog Aadhaar (if available).

- Proof of shop & establishment or any other business registration document (if available).

- SBI savings or current account number and branch details.

5. What is the interest rate for the SBI E-Mudra Loan?

- The interest rate is linked to the External Benchmark Lending Rate (EBLR). As of March 2025, the PMMY scheme related to agriculture is offered at an interest rate of 11.75% per annum. For the most accurate and current rates, it’s advisable to contact SBI directly.

6. What is the repayment tenure for the loan?

- The repayment tenure for the SBI E-Mudra Loan is up to 5 years.

7. Is there any processing fee for the loan?

- There is no processing fee for Shishu and Kishore loans to Micro and Small Enterprises (MSE) units. For Tarun loans, a processing fee of 0.50% of the loan amount applies.

8. Do I need to provide any collateral or margin money?

- No collateral is required as the loan is guaranteed by the Credit Guarantee Fund for Micro Units (CGFMU). For loans up to ₹50,000, there is no margin requirement.

9. What is a MUDRA Card?

- A MUDRA Card is a debit card issued to borrowers, allowing them to withdraw money in portions from the sanctioned loan amount. It functions like a debit-cum-ATM card for business-related purchases.

10. How long does it take for the loan to be approved and disbursed?

- The processing time is approximately 7-10 working days from the date of application submission. However, this may vary depending on the applicant’s profile, loan amount, and nature of the business.

11. Can individuals in urban areas apply for the SBI E-Mudra Loan?

- Yes, individuals residing in both urban and rural areas are eligible to apply for the SBI E-Mudra Loan.

12. Is there any subsidy provided under the MUDRA loan scheme?

- No, there is no subsidy provided under the MUDRA loan scheme.

13. How can I download the SBI MUDRA loan application form?

- To apply for an SBI MUDRA loan, applicants need to download the loan application form from the official SBI website or visit the nearest SBI branch for assistance.

14. What should I do if my loan application is denied?

- If your loan application is rejected and you believe it was on unjust grounds, you can escalate the matter to higher authorities within the bank. However, the approval of loan applications is at the bank’s discretion, based on factors like creditworthiness and financial stability.